, Jun 6, 2017

In 2016, Brazilian banking sector’s investment in technology was of R$ 18,6 billion, according to Febraban 2017 Banking Technology Survey. For the most part, financial injections were directed at process and business digitalization to improve customer service. Logicalis, global provider of information and communication technologies services and solutions, has been increasingly supporting financial institutions in their digital transformation process. Some of these solutions are presented at CIAB 2017, from June 6th to 8th, in Sao Paulo.

For a better idea of the challenges faced by the sector, in 2016, 65 billion transactions were made, and 34% of them via mobile banking – a 96% increase in relation to the previous year. Furthermore, currently, around 55 million Brazilians under 18 years old don’t have a bank account and are searching for digital services.

To attract these younger customers with services aligned to their needs and, at the same time, support online transactions increase, companies must update infrastructures, streamlining and automating processes, while migrating systems to the cloud. However, defining the best destiny for each application, whether public or private cloud or own infrastructure, is no easy task.

Logicalis acts as an advisor during the entire process – from application assessment, to cloud migration and services management and operation -, always aligned to each organization’s needs. The purpose is to develop a customized project, focused on improving IT systems and paving an evolutionary path, while preserving client’s previous made investments.

“We like to say that cloud is not for everything, therefore, we usually run an advisory diagnosis to assess not only applications that are currently hosted, which ones could be moved to the cloud and which cloud model is most appropriated, but also to assess necessary connectivity and security resources for this migration”, says Paulo Torres, Logicalis’ services director for Latin America.

Another important point for banks is operational costs reduction, which contributes to institution’s increased profitability provided by the adoption of cloud solutions. Also, there are technologies increasingly robust capable of insuring application and information security, minimizing vulnerabilities even when hosted in public clouds.

In addition to providing infrastructure, cloud, services and security technologies to financial institutions, Logicalis also offers groundbreaking technologies, such as blockchain and internet of things (IoT); and has been supporting financial sector organizations in improving operational efficiency and putting the customer at the heart of decision-making.

Below are some highlights to be carried out by Logicalis at CIAB 2017:

IoT for insurance companies

Logicalis will present an IoT project for car insurers. Resources such as telemetry, driver & vehicle information capture – driver’s profile, mileage, fuel consumption, brakes usage and maintenance – and analytics tool, so insurers can provide a better experience and a more personalized insurance policy to customer.

Electric Energy Efficient Management

One IoT project under development that will be showcased at Logicalis’ booth is directed at energy management, a constant point of worry for banks. With this technology, it’s possible to monitor energy consumption in real time by different aspects – equipment, machines, floors, sectors, among others – and, based on these data, take actions to reduce energy expenditures.

Cloud

Event attendees will also be able to witness hybrid cloud management and interactions, which, to facilitate decision making, also gives the value for hosting an application in each cloud option. Furthermore, it will be possible to observe the disaster recovery of a customized virtual machine, in real time, using Microsoft Azure.

Blockchain

The booth will also offer a practical application demonstration of the sustainability-directed technology. Created in partnership with EQAO, company developing renewable energy and carbon credit projects, the ZCO2 is a points program which acknowledges sustainable practices and behaviors. Thus, every time a customer opts for a product or service that reduces greenhouse gas emissions, they receive Z points – encrypted currencies based on blockchain and backed by Carbon Credit.

Also present in Logicalis’ booth will be technology partners Algosec, Citrix, IP Trade and Ixia.

Service: CIAB Febraban

Date: June 6th to 8th

Location: Expo Center Transamerica

Booth’s location: C3

Conteúdos relacionados

Brazil , Dec 8, 2025

Pesquisa exclusiva da Logicalis aponta que empresas priorizarão eficiência operacional, transformação de processos críticos e segurança para 2026

A maior parte das companhias (60%) projeta crescimento no orçamento de TI

Brazil , Dec 8, 2025

Logicalis abre inscrições para o seu Programa de Estágio 2026

Estudantes têm até o dia 18 de janeiro para se candidatar

Brazil , Dec 5, 2025

Logicalis recebe Selo de Igualdade Racial e reforça compromisso com diversidade

Reconhecimento destaca o propósito da empresa com inclusão, equidade racial e ações de impacto social

Brazil , Nov 6, 2025

Logicalis é reconhecida como Parceira do ano da Cisco para a América Latina

Ao todo a empresa recebeu 12 prêmios na região, sendo seis deles no Brasil, reforçando trajetória de crescimento ao longo dos últimos meses.

Brazil , Oct 17, 2025

Logicalis é finalista do “Digital Customer Success Innovator of the Year” pela TSIA!

A Logicalis atingiu a reta final no TSIA STAR Awards 2025 na categoria Digital Customer Success Innovator of the Year.

Brazil , Oct 3, 2025

Logicalis atinge nível Elite no programa de parcerias da Splunk

Conquista reforça a posição da Logicalis como parceira estratégica da Splunk na América Latina, ampliando benefícios para clientes em segurança, observabilidade e transformação digital.

Brazil , Aug 28, 2025

Logicalis abre inscrições para a oitava turma do Programa Level Up

Inscrições poderão ser feitas entre os dias 26 de agosto e 20 de setembro

Brazil , Jul 10, 2025

Logicalis é uma das parceiras da Vale no projeto Voa Maracanã, que beneficia 700 famílias em situação de vulnerabilidade no Maranhão

Iniciativa é focada em ações de enfrentamento à pobreza e na melhoria da vida de 700 famílias em comunidades rurais de São Luís – MA

Brazil , May 8, 2025

Logicalis abre inscrições para o Level Up 2025 com foco em Cibersegurança e Diversidade

Interessados com mais de 18 anos podem se inscrever até o dia 30 de maio para o curso, que é totalmente on-line e gratuito

Brazil , Jan 13, 2025

Logicalis anuncia mudança de comando na América Latina

A partir de 1º de março de 2025, Marcio Caputo, atual Vice-presidente do Brasil e COO Latam, assume como CEO para a região, posição ocupada por Rodrigo Parreira, que passará a atuar como consultor da Logicalis Group.

Brazil , Dec 12, 2024

Logicalis abre inscrições para o seu Programa de Estágio 2025

Estudantes têm até o dia 24 de janeiro para se candidatar

Latin and South America , Nov 22, 2024

In the news

Cybermonday: ameaças cibernéticas e medidas de proteção

Com a chegada da Cybermonday, é inevitável pensar nos cibercrimes e cibercriminosos que se tornam mais ativos quando a demanda por tecnologia aumenta. De fato, o Logicalis CIO Report 2024 destaca que a região sofre 1.600 ataques cibernéticos por segundo, sendo o ransomware um dos mais comuns. Além disso, nos primeiros seis meses de 2024, a América Latina enfrentou uma alta diversidade de malware, com uma média de 2,6 milhões de amostras únicas.

Brazil , Nov 12, 2024

Logicalis implementa SD WAN em 57 lojas de grande rede de material de construção

Grande rede varejista de material de construção está passando por um processo de substituição de sua rede SD WAN e atualização de sua arquitetura, com apoio da Logicalis

Brazil , Nov 7, 2024

A Logicalis renova o status de Microsoft Global Azure Expert MSP

O status de Microsoft Global Azure Expert MSP, conquistado pela Loicalis, é considerado o mais alto padrão possível de serviços gerenciados de nuvem do parceiro.

Brazil , Nov 6, 2024

CIOs indicam tendências e desafios do 5G e IoT

94% dos líderes de TI brasileiros estão investindo ou planejam investir em 5G privado e 98% afirmaram ter iniciativas ligadas a IoT. Pesquisa da Logicalis confirma que os CIOs buscam benefícios com o 5G, mas ainda existe espaço para melhor entendimento da tecnologia.

Brazil , Oct 30, 2024

Logicalis é eleita Parceira Global de Sustentabilidade no Cisco Partner Summit 2024

Além do prêmio global por suas práticas sustentáveis pelo segundo ano consecutivo, empresa venceu mais seis categorias na América Latina

Brazil , Oct 15, 2024

Marcio Caputo assume como Vice-presidente Executivo da Logicalis no Brasil

Executivo tem como missão liderar as operações no País e expandir a presença da empresa de forma estratégica

Brazil , Oct 10, 2024

Logicalis e Red Hat lançam solução para acelerar automação de redes na América Latina

Network Automation une os recursos do Red Hat Ansible Automation Platform com os serviços da Logicalis para entregar segurança, eficiência operacional e redução de custos

Brazil , Aug 21, 2024

Logicalis abre segunda turma para o Programa Level UP, que impulsiona a capacitação de mulheres em TI

Mulheres com mais de 18 anos podem se inscrever até o dia 19 de setembro para o curso, que é totalmente on-line e gratuito

Brazil , Aug 20, 2024

Programa da Logicalis capacita pessoas com deficiência nas áreas de tecnologia e administração

Inscrições podem ser feitas até o dia 17 de agosto e ao final do curso os participantes integrarão o banco de talentos da Logicalis

Brazil , Aug 7, 2024

Logicalis lança modelo de soluções de colaboração como serviço

Nova modalidade permitirá às empresas viabilizarem economicamente o acesso a tecnologias de videoconferência de última geração, descartando a necessidade de investimento inicial e com serviços de gestão que garantem maior eficiência da infraestrutura

Brazil , Jul 10, 2024

Splunk é a nova parceira da Logicalis Latam!

A Splunk, recente aquisição da Cisco, é uma aliança estratégica da Logicalis na América Latina!

Brazil , Jul 2, 2024

Logicalis foi reconhecida no Microsoft Partner of the Year Americas!

A excelência da Logicalis como provedora de soluções e serviços de TIC foi reconhecida no Microsoft Partner of the Year Awards2024.

Brazil , Jun 3, 2024

Programa da Logicalis impulsiona capacitação de mulheres em TI

Iniciativa gratuita e focada em profissionais femininas está com inscrições abertas até 23 de junho

Brazil , May 22, 2024

Metas de emissões net-zero da Logicalis são aprovadas pela iniciativa Science Based Targets (SBTi)

Empresa assumiu compromisso global de atingir emissões net-zero até 2050 e carbono neutro nos Escopos 1 e 2 até 2025

Brazil , Apr 24, 2024

Dia Mundial da IoT: 58% das empresas na América Latina já possuem iniciativas de internet das coisas, de acordo com o IoT Snapshot 2024

Nova edição do estudo também avalia a incorporação de tecnologias de Inteligência Artificial e de 5G nos projetos de IoT

Brazil , Apr 3, 2024

Logicalis conquista status de Managed Extended Detection and Response da Microsoft

A Logicalis se junta a um grupo de elite de provedores de serviços gerenciados certificados para fornecer os serviços gerenciados de detecção e resposta mais avançados da Microsoft em todo o mundo

Brazil , Jan 4, 2024

Logicalis abre inscrições para nova turma do programa de capacitação em TI para grupos minorizados

Iniciativa gratuita e focada em negros já formou mais de 30 profissionais

Brazil , Jan 3, 2024

Logicalis firma parceria com USP para apoiar estudantes em situação de vulnerabilidade socioeconômica

Programa USP Diversa oferece apoio a alunos de graduação provenientes de escolas públicas

Brazil , Dec 14, 2023

Logicalis conquista FlashArray Certified Implementation Partner, importante selo da Pure Storage

A empresa é a primeira parceira da Pure Storage na América Latina a receber o selo de FlashArray Certified Implementation Partner, da Pure Storage.

Brazil , Nov 10, 2023

Logicalis é premiada como Parceira Global de Sustentabilidade do Ano no Cisco Partner Summit 2023

Empresa é destaque no primeiro ano da premiação por suas iniciativas em sustentabilidade e o sucesso em ajudar os clientes a reduzir o impacto ambiental de suas infraestruturas de TI em todo o mundo.

Global , Oct 11, 2023

Concretizando casos de uso: Logicalis cria casos de uso específicos do cliente com os laboratórios de 5G privado

Logicalis cria casos de uso específicos do cliente com os laboratórios de 5G privado

Brazil , Aug 24, 2023

Logicalis anuncia nova Chief People & Administration Officer

Luciana Depieri assume com o desafio de impulsionar o posicionamento da companhia como uma empresa de serviços continuados em tecnologia

Brazil , Aug 18, 2023

Logicalis registra crescimento de 60% na venda de soluções e serviços Microsoft

A Logicalis obteve no fiscal year 2023 (FY23) um crescimento de 60% de vendas Microsoft, se comparado com o ano anterior.

Brazil , Aug 3, 2023

Logicalis lança podcast de tecnologia no AWS Summit 2023

O podcast Digitizeme conta com quatro episódios que abordam os temas de Modernização de Aplicações, FinOps, ESG e Realtime Analytics.

Brazil , Jul 6, 2023

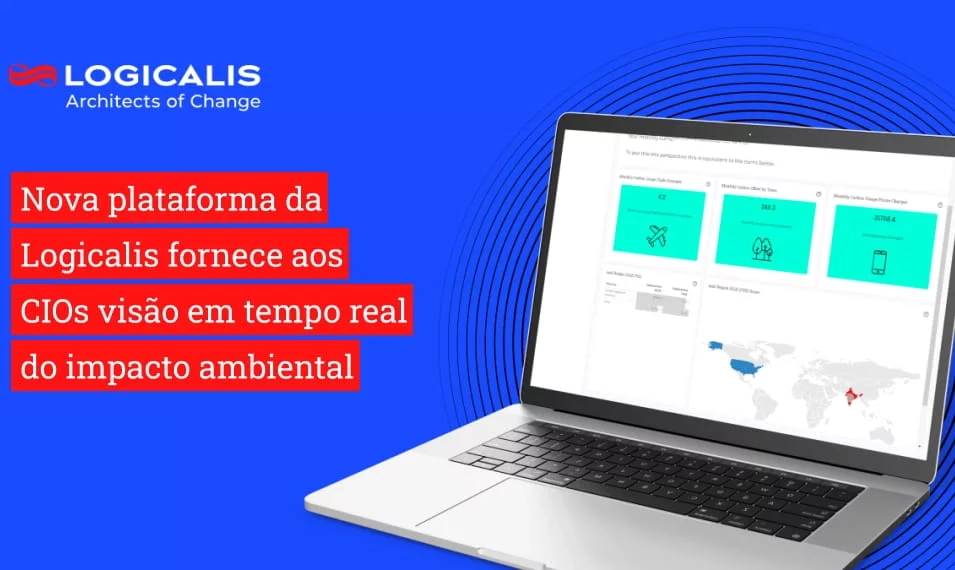

Nova plataforma da Logicalis fornece aos CIOs visão em tempo real do impacto ambiental

O Digital Fabric Platform da Logicalis oferece aos usuários uma visão instantânea de seu desempenho digital em cinco métricas-chave, incluindo o impacto ambiental

Brazil , Jul 5, 2023

Logicalis abre inscrições para nova turma do programa de capacitação em TI para grupos minoritários

Iniciativa gratuita e focada em profissionais negros está com inscrições abertas até 31 de julho

Brazil , Jun 29, 2023

Logicalis renova sua certificação como Cisco Global Gold Integrator

Como um dos apenas seis parceiros certificados como Global Gold da Cisco, a Logicalis tem obtido sucesso ao entregar inovação, engajamento e valor para clientes em todo o mundo

Brazil , Jun 28, 2023

CIOs se reúnem para tratar de sustentabilidade no Logicalis CIO Summit 2023

O ESG está crescendo e ganhando importância para os clientes de TI

Brazil , Jun 28, 2023

Logicalis é vencedora em três categorias do Microsoft Partner of the Year Award

Empresa foi destaque em Azure, Industry e Business Transformation

Brazil , Jun 22, 2023

Estudo da Logicalis indica que 45% das empresas brasileiras migraram ou estão migrando para a nuvem, mas apenas 34% têm processos de governança de custos na nuvem (FinOps)

De acordo com levantamento, apenas 22% das companhias brasileiras contam com uma equipe dedicada para a gestão financeira dos serviços em cloud

Brazil , May 30, 2023

Apenas 36% das organizações brasileiras afirmam estar totalmente aderentes à LGPD

Dois anos após a entrada da lei em vigor, 43% das empresas ainda estão em processo de adoção de iniciativas de adequação à LGPD e 6% ainda não têm ações específicas

Brazil , Apr 12, 2023

Pesquisa da Logicalis aponta tendência por serviços de TI para contornar a escassez de profissionais qualificados no mercado

De acordo com estudo IT Trends Snapshot 2023, 94% das empresas foram impactadas pela escassez de profissionais qualificados e 82% estão ampliando o uso de serviços como forma de garantir a continuidade dos negócios

Brazil , Mar 17, 2023

Liderança ousada leva CIOs a assumir papel de destaque nas decisões de negócios, aponta estudo da Logicalis

De acordo com levantamento Global CIO Report 2023, 50% dos executivos de TI afirmam que o conselho da empresa espera que eles ofereçam inovação contínua

Brazil , Mar 6, 2023

Logicalis firma parceria com a Iniciativa Empresarial pela Igualdade Racial

Acordo tem como objetivo reforçar estratégia da empresa voltadas à diversidade e inclusão

Brazil , Feb 23, 2023

Logicalis adere à Carta de Princípios da Brasscom

Iniciativa visa o fortalecimento das relações formais de trabalho, reforçando os compromissos das empresas com os valores ESG, como a transparência, a legalidade e a governança

Brazil , Feb 16, 2023

Logicalis lança programa de capacitação em TI para grupos minoritários

Primeira edição será focada em profissionais negros e tem como objetivo impulsionar o desenvolvimento de competências na área de tecnologia

Brazil , Feb 10, 2023

Logicalis inicia operação na República Dominicana

Com o anúncio, empresa passa a atuar em 12 países na América Latina

Brazil , Feb 8, 2023

Logicalis Brasil lança seu primeiro relatório de sustentabilidade

Documento aborda as ações da organização focadas em ESG e sua oferta de soluções tecnológicas voltadas a promover práticas sustentáveis

Brazil , Jan 17, 2023

Intelbras instala rede 5G privada para desenvolvimento de soluções tecnológicas

Laboratório de testes está localizado na matriz da empresa; iniciativa envolve colaboração com Logicalis, Qualcomm, Microsoft e Telecom Infra Project

, Jun 29, 2022

Kumulus é eleita parceira do ano da Microsoft

Criada em 2017, com foco em cloud e data analytics, a empresa vem crescendo mais de 180% anualmente

, Jun 15, 2022

Logicalis anuncia parceria em 5G com a Oracle

Com a parceria, a Oracle fornecerá funções de rede nativas em nuvem, que passam a compor as soluções de 5G oferecidas pela Logicalis para provedores de serviços em toda a América Latina.

, Jun 7, 2022

Logicalis cria grupos de afinidades para promover discussões e iniciativas a respeito da diversidade e inclusão corporativa

O objetivo é incorporar o assunto de forma completa, com a conscientização de toda a companhia a respeito da inclusão de grupos minoritários

, Jun 6, 2022

Logicalis anuncia compromisso de se tornar carbono neutro até 2025

Meta global envolve as operações da empresa em 27 países

, May 31, 2022

Logicalis cresce 16% na América Latina

Brasil respondeu por mais de 60% do resultado da região

, May 19, 2022

Para 57% dos executivos brasileiros, a inovação é um pilar da estratégia corporativa, aponta IoT Snapshot 2022

A quinta edição do estudo também mostra que 33% das organizações brasileiras e 13% das hispano-americanas participam de hubs de inovação visando aproximação com startups

, May 4, 2022

IoT Snapshot 2022 aponta que 42% das empresas no Brasil planejam investir em projetos de IoT nos próximos 18 meses

Segundo o levantamento realizado pela Logicalis, a tecnologia já é uma realidade na América Latina e segue em expansão

, Apr 25, 2022

Logicalis elege solução de base de dados da HPE para compor sua oferta de 5G no Brasil

Com o HPE Shared Data Environment (SDE), que incorpora a base de dados do 5G e 4G, composto pelos elementos UDR 5G, UDR 4G, UDM e AUSF e o gerenciamento especializado da Logicalis, as companhias conseguem entregar a melhor solução 5G para as operadoras e empresas

, Apr 11, 2022

Logicalis realiza primeira chamada 5G em ambiente de teste

Empresas interessadas na construção de redes 5G terão acesso a demonstrações e simulações de uso da nova tecnologia

, Apr 8, 2022

Logicalis recebe especializações avançadas de segurança da Microsoft

A conquista valida o conhecimento, ampla experiência e expertise da Logicalis na área

, Apr 4, 2022

Logicalis realiza primeira chamada 5G em ambiente de teste

Empresas interessadas na construção de redes 5G terão acesso a demonstrações e simulações de uso da nova tecnologia

, Mar 29, 2022

Logicalis e IBM colaboram para acelerar adoção de 5G nos negócios da América Latina

Companhias ajudarão os provedores de serviços de Internet com automação, orquestração e gerenciamento das redes 5G.

, Mar 15, 2022

Logicalis promove mudanças na sua estrutura na América Latina e reforça sua estratégia de foco no cliente

Entre as novidades estão as nomeações de Riccardo Modica para Vice-presidente Executivo no Brasil e de Marcio Caputo para COO Latam

, Feb 25, 2022

Logicalis é reconhecida como uma das 100 melhores empresas de outsourcing pela IAOP

Esta é a sétima vez consecutiva que a empresa integra a lista da Associação Internacional de Profissionais de Outsourcing®

, Feb 21, 2022

Logicalis nomeia Alejandro Sajón como country manager para Argentina, Paraguai e Uruguai

Executivo chega à empresa com o objetivo de promover a transformação e o crescimento dos negócios do cluster Argentina, Paraguai e Uruguai

, Feb 17, 2022

Logicalis anuncia novo CFO para a América Latina

O executivo terá a missão de liderar o time de finanças e apoiar a jornada de transformação digital dos clientes, criando valor de forma sustentável em toda a cadeia

, Jan 19, 2022

Logicalis é reconhecida como líder em estudo do ISG sobre soluções AWS

Empresa foi eleita líder em quatro dos seis quadrantes do estudo ISG Provider Lens™ AWS Ecosystem Partners 2021, que acaba de ser divulgado.

, Jan 7, 2022

Logicalis conquista certificação DevNet da Cisco

Reconhecimento atesta a capacidade de entregar soluções customizadas aos clientes

, Jan 6, 2022

Logicalis renova certificação Microsoft Azure Expert

Pelo 3º ano consecutivo, a empresa se mantém entre os principais 1% dos parceiros Microsoft em todo o mundo

, Jan 6, 2022

Logicalis reforça equipe com foco na expansão das operações no Rio de Janeiro e Espírito Santo

O objetivo é ampliar a presença nos segmentos de finanças, indústrias, saúde e energia

, Jan 6, 2022

Logicalis reforça equipe para expandir operações no Rio Grande do Sul

Ao lado de Beatriz Campolina, Ariadne Osandabaráz será responsável por ampliar a atuação da multinacional na região Sul do país

, Jan 4, 2022

Logicalis reforça equipe com foco no crescimento das operações no Paraná

Ampliação do time de vendas faz parte da estratégia para expandir a atuação no estado

, Dec 16, 2021

Apenas um terço dos CIOs cita a mitigação de riscos cibernéticos como uma medida de performance

Estudo da Logicalis revelou que quase metade dos entrevistados (47%) vê as violações de dados como o maior risco para suas organizações

Brazil , Dec 14, 2021

Logicalis é líder em dois quadrantes no Estudo ISG Provider Lens™ Analytics Services 2021

A empresa conquistou a liderança em Data Science Services e em Data Engineering Services.

, Dec 9, 2021

CIOs dedicam hoje mais tempo à inovação do que nunca

Apesar dos esforços, menos de um terço descreve a inovação como parte da cultura da empresa

, Dec 6, 2021

Kan Wakabayashi é o novo CTO da Logicalis para a América Latina

O executivo tem a missão de desenvolver um portfólio de soluções e serviços que impulsione a transformação digital dos clientes da Logicalis

, Dec 2, 2021

Logicalis renova certificação Master Data Center & Hybrid Cloud da Cisco

Com esta recertificação, a empresa continua como a única parceira Brasil com todos os Masters Cisco.

, Dec 2, 2021

Logicalis é destaque em oferta Cloud do Relatório ISG Provider Lens™ Public Cloud 2021

A capacidade da Logicalis de apoiar seus clientes na migração para a nuvem garantiu à empresa uma posição de destaque no relatório

, Dec 2, 2021

75% dos CIOs lutam para extrair insights de dados dentro de sua organização

Embora 78% das empresas percebam o valor da transformação digital, apenas um quarto delas usa dados para conduzir a estratégia de negócio

, Nov 25, 2021

CIOs priorizam a inovação para melhorar as conexões digitais dos clientes

O estudo revela que os respondentes afirmam que suas prioridades são inovação, eficiência operacional e experiência do cliente.

, Nov 10, 2021

Logicalis é premiada em seis categorias no Cisco Partner Summit 2021

Entre os destaques estão o reconhecimento como Mass Scale Infrastructure Partner of the Year para as Américas e Brasil e Parceiro do Ano no Brasil

, Nov 8, 2021

Logicalis é destaque do VI Prêmio Compliance ESG Brasil 2021

O reconhecimento certifica a excelência da gestão corporativa da empresa, que valoriza as iniciativas de integridade por meio do compliance atrelado ao ESG

, Oct 20, 2021

Logicalis lança solução Global de Segurança

No centro da solução Secure OnMesh estão as capacidades nativas de nuvem e a inteligência artificial do Azure Sentinel, combinadas ao poder do Cisco Secure X

, Oct 20, 2021

Logicalis está entre as melhores empresas para se trabalhar no Brasil

A empresa conquistou a posição 23º do GPTW , na categoria “Grandes empresas”

, Oct 13, 2021

Logicalis está entre as 20 melhores empresas do Brasil do Anuário Época 360

A Logicalis conquista a 18ª posição entre as 418 melhores empresas do país

, Oct 5, 2021

Logicalis filia-se à Microsoft Intelligent Security Association (MISA)

Objetivo é unir forças com diversos players da indústria para combater as ameaças digitais

, Sep 2, 2021

Plataforma da Logicalis facilita o acesso a soluções de IoT

Baseado em Azure, o EUGENIO 2.0 permite a qualquer cliente que já utiliza a plataforma da Microsoft habilitar o sistema, acelerando a adoção da Internet das Coisas

, Aug 26, 2021

Logicalis oferece ferramenta para avaliar a maturidade digital das empresas

Reconhecida pelo ISG com líder em consultoria em Digital Business, companhia decidiu divulgar uma versão resumida do Assessment realizado em seus projetos

, Aug 23, 2021

Logicalis neutraliza emissões de gases de efeito estufa de 2020

A ação da empresa compõe uma carteira de compensação de emissões, que contêm energia renovável e eólica, bem como projetos de conservação de florestas e “desenvolvimento limpo”

, Aug 17, 2021

Logicalis é reconhecida como líder pelo IDC no estudo MarketScape

Pesquisa atesta excelência dos serviços de consultoria de rede em todo o mundo, destacando a Logicalis como Worldwide Network Consulting Services 2021 Vendor Assessment

, Aug 11, 2021

Estudo da Logicalis aponta as prioridades de negócio e de tecnologia das empresas brasileiras

Segurança da informação e adequação à LGPD são as principais prioridades para mais de 50% das organizações nos próximos meses

, Aug 4, 2021

Logicalis está entre as 15 Melhores Empresas do GPTW Latin America 2021!

Neste ano, a empresa foi reconhecida na categoria Multinacionais e está entre as 15 melhores companhias para se trabalhar na América Latina

, Aug 4, 2021

Logicalis apoia projeto para impulsionar presença feminina no mercado de TI

Como parte de suas ações voltadas à inclusão do público feminino no mercado de tecnologia, a Logicalis é uma das patrocinadoras do Women Rock IT (WRIT), da Cisco

, Jul 28, 2021

Logicalis lança série animada para despertar interesse das crianças por carreiras ligadas à tecnologia

Episódios da Megaliga serão compartilhados a cada quinze dias no canal do YouTube da empresa e, com linguagem lúdica, apresentam o poder transformador da TI

, Jul 21, 2021

De olho na 5G, Logicalis associa-se à comunidade de padrões abertos de conectividade

Filiação ao Telecom Infra Project (TIP) permite a troca mais intensa de conhecimento com as empresas que estão à frente do movimento por padrões abertos

, Jul 8, 2021

Logicalis é vencedora em quatro categorias do Microsoft Partner of the Year Award

A excelência da Logicalis como provedora de soluções e serviços de TIC mais uma vez foi reconhecida. A empresa venceu em quatro categorias do Microsoft Partner of the Year Award, sendo o parceiro com o maior número de premiações para a região da América Latina e Caribe.

, Jul 8, 2021

Logicalis anuncia contratação de diretor focado em desenvolvimento de negócios em parceria com a Microsoft

Chegada de Rodolfo Roim está alinhada à estratégia da empresa de impulsionar o crescimento em soluções de cloud e serviços gerenciados

, Jun 30, 2021

Logicalis expande operação regional e reforça presença em MG

Marcelo Pantaleão assume como Head de Vendas para Regionais e tem como principal desafio ampliar os negócios no mercado mineiro

, Jun 21, 2021

Logicalis mantém rentabilidade na América Latina em meio à pandemia

Período foi marcado pela conquista de novos projetos ligados à transformação digital e pelo crescimento dos negócios com parceiros de nuvem pública

, Jun 10, 2021

Logicalis fortalece sua estratégia de Cloud e se posiciona como fornecedor completo de soluções em nuvem

Entre as principais iniciativas da empresa para este ano, estão o fortalecimento do seu ecossistema de parcerias — que já contava com os maiores provedores de nuvem do mundo — e a contratação de Alexandre Theodoro como diretor da unidade de Cloud

, Jun 8, 2021

Logicalis adquire a empresa siticom, especialista em infraestrutura avançada de rede e soluções 5G

O investimento reforça a capacidade da Logicalis de entregar serviços definidos por software para os clientes que buscam conectar pessoas e dispositivos

, Jun 3, 2021

Logicalis adquire participação majoritária na Kumulus para acelerar a jornada dos seus clientes para a nuvem

Com a aquisição, a Logicalis complementa o seu portfólio de soluções com a expertise da Kumulus em modernização de aplicações e gestão de ambientes de nuvem híbrida

, Jun 2, 2021

Para acelerar a digitalização dos serviços públicos, Logicalis cria estrutura dedicada ao desenvolvimento de negócios junto ao governo

A demanda crescente pela simplificação do acesso da população a serviços por meio da digitalização insere o setor no centro da estratégia da companhia

, Jun 2, 2021

Logicalis anuncia novo diretor de Serviços de TI para América Latina

A Logicalis acaba de anunciar Leonardo Malvar como diretor de Serviços de TI para América Latina. O executivo ficará responsável pela área na região, além de responder pela gestão dos Centros de Operações de Segurança (SOCs) existentes no Brasil e na Colômbia.

, May 26, 2021

Logicalis anuncia novo diretor de tecnologia e portfólio na América Latina, com foco na Transformação Digital da região

A Logicalis acaba de nomear Christian Hisas como Diretor de Tecnologia e Portfólio da Logicalis para América Latina

, May 17, 2021

Logicalis abre as inscrições para segunda edição do programa de estágio para alunos brasileiros em formação no exterior

O Summer Talent Logicalis 2021 será 100% online e tem como objetivo fomentar a inovação, a troca de experiências e a diversidade de visões

, May 13, 2021

Logicalis fortalece parceria com Microsoft para acelerar evolução das operadoras na América Latina

Empresa incorpora nova solução ao seu portfólio para apoiar empresas de telecomunicações da região em seus desafios futuros

, May 13, 2021

Logicalis é líder em Digital Business Consulting, pelo ISG Provider Lens™

A empresa foi reconhecida por fornecer serviços consistentes de consultoria em negócios digitais de alta qualidade para auxiliar os clientes em sua transformação digital

, May 12, 2021

Markus Erb se une à Logicalis como novo VP de serviços do grupo, conduzindo o alinhamento global de Serviços Gerenciados

A Logicalis anunciou a nomeação de Markus Erb como vice-presidente de serviços do grupo para conduzir o alinhamento e inovação na recém estabelecida Organização Global de Serviços (GSO) da Logicalis

, May 10, 2021

Logicalis é um dos patrocinadores do projeto Xadrez para Todos

Conhecendo o valor do esporte para seus funcionários e os benefícios que ele proporciona, a empresa viu na ação social uma oportunidade de incentivar a educação de forma lúdica e transformadora

, May 6, 2021

Logicalis anuncia Marcelo Silva como novo diretor de vendas Enterprise

O executivo será responsável pela liderança do relacionamento e o desenvolvimento de negócios para acelerar a transformação digital dos clientes

, Apr 19, 2021

Logicalis tem novo diretor de consultoria para Saúde

Marcello Albuquerque chega com a missão de aumentar a representatividade da área no faturamento da companhia

, Apr 14, 2021

Logicalis reforça liderança no Brasil para ampliar atuação em 5G

Daniela Almeida assume diretoria de Tecnologia da empresa

, Apr 6, 2021

Logicalis adquire empresa espanhola de cibersegurança

A Logicalis anuncia hoje a aquisição de uma participação majoritária na Áudea, empresa especializada em cibersegurança e conformidade regulatória

, Apr 6, 2021

Paulo Torres é o novo COO da Logicalis Brasil

Executivo conta com mais de 25 anos de atuação no mercado de tecnologia e está há mais de nove na companhia

, Mar 10, 2021

Logicalis se consolida como uma das principais provedoras de serviços na América Latina

Com integração regional de atendimento e portfólio fim a fim, empresa conquista a premiação da IAOP® pelo sexto ano consecutivo

, Mar 8, 2021

Logicalis promove evento em parceria com Microsoft, Block C e Duratex S.A para discutir os impactos gerados pela emissão de gás carbônico das empresas

Entre os palestrantes estão os CEOs da Logicalis na América Latina, Rodrigo Parreira, e da Microsoft Brasil, Tânia Cosentino, além de Marcelo Furtado, sócio fundador da Block C, Marina Grossi, do Conselho Empresarial Brasileiro para o Desenvolvimento Sustentável e Giancarlo Tomazim, gerente de Inovação Corporativa da Duratex S.A

, Feb 26, 2021

Logicalis está entre as 16 melhores empresas para se trabalhar em São Paulo

A empresa foi reconhecida na categoria “Região Metropolitana – Grandes” e está entre as 16 melhores companhias para se trabalhar em São Paulo

, Feb 23, 2021

Logicalis renova certificação global em serviços gerenciados para a nuvem Microsoft Azure Expert

A Logicalis, empresa global de soluções e serviços de tecnologia da informação e comunicação, renovou sua certificação Microsoft Azure Expert Managed Services Provider (MSP)

, Jun 17, 2020

Logicalis aplica Inteligência Artificial para aprimorar a segurança e garantir a continuidade dos negócios de seus clientes

Com a tecnologia, empresa passa a oferecer uma plataforma de serviço digital que apoiará as organizações a acelerarem a inovação e adaptação à economia digital

, Jun 4, 2020

Logicalis entre as melhores empresas para trabalhar na América Latina de acordo com o Great Place to Work®

A empresa atingiu a posição 20 na categoria de empresas multinacionais

, Jun 1, 2020

Logicalis é pela quinta vez consecutiva uma das 100 melhores empresas de outsourcing pela IAOP

A Logicalis, empresa global de soluções e serviços de tecnologia da informação e comunicação, foi reconhecida pela quinta vez consecutiva como uma das 100 melhores empresas de outsourcing pela IAOP - Associação Internacional de Profissionais de Outsourcing®.

, Mar 6, 2020

Logicalis recebe o status Azure Expert Managed Services Provider, da Microsoft

A empresa está entre as 65 companhias no mundo a receber a certificação

, Oct 14, 2019

Logicalis registra crescimento de 19% em receita líquida na América Latina

Resultado reforça importância da região para a companhia, que cresce cerca de 20% pelo segundo ano consecutivo

, Dec 17, 2018

Par perfeito

Um casamento que deu certo. Assim pode ser traduzida a parceria da Logicalis com a Cisco, que completa 20 anos em 2018.

, Dec 17, 2018

Área de serviços agora é Optimal Services em toda América Latina

Objetivo é deixar claro que todos os países da região entregam a mesma experiência para o cliente

, Dec 17, 2018

De olho na performance das aplicações

A AppDynamics, cujos produtos fazem parte do portfólio da Cisco desde sua aquisição no início de 2017, nomeou a Logicalis como seu braço de serviços para toda a América Latina. O monitoramento de aplicações dá visibilidade aos sistemas em tempo real e de forma simples, identificando e tratando os problemas rapidamente.

, Sep 4, 2018

Logicalis conclui aquisição do grupo Coasin no Chile e no Peru

Integração traz robustez às operações e potencializa a visão da Logicalis como protagonista da transformação digital na América Latina

, Jun 11, 2018

Logicalis contribui para transformação digital do setor financeiro

Empresa oferece um portfólio completo de soluções para auxiliar as instituições, desde a melhoria do atendimento ao cliente até a digitalização de seus processos

, Apr 2, 2018

Logicalis destaca impacto da transformação digital nos data centers

Empresa auxilia clientes a definir melhor estratégia para processar, armazenar e gerenciar aplicações e informações na nuvem

, Mar 22, 2018

Logicalis firma parceria com Canonical

Juntas, empresas pretendem impulsionar adoção de open source na América Latina, principalmente em soluções relacionadas à nuvem

, Nov 7, 2017

Logicalis é parceira do ano da Cisco na América Latina

Premiação reconhece a excelência técnica de sua equipe e a capacidade de atender às necessidades de seus clientes em toda a região

, Sep 20, 2017

Logicalis firma parceria com Itron

Acordo visa acelerar crescimento de smart grids no Brasil e contribuir para que as redes de distribuição de energia sejam mais inteligentes

, Aug 15, 2017

Logicalis é a 17º melhor empresa no ranking GPTW Brasil

O resultado do ranking 2017 comprova o forte investimento realizado pela Logicalis no desenvolvimento de seus profissionais nos últimos anos

, Jul 27, 2017

Computação em nuvem se consolida e já é usada por 82% das empresas brasileiras

IT Brazil Snapshot, estudo realizado pela Logicalis, apresenta cenário de maturidade de uso e adoção tecnologia no País

, Jul 12, 2017

Logicalis e Microsoft anunciam parceria estratégica na América Latina

Acordo engloba todo o portfólio da fabricante e está alinhado à estratégia da Logicalis de ser o parceiro ideal do cliente durante a transformação digital

, Jul 4, 2017

Logicalis adquire NubeliU

Negócio reforça o portfolio da empresa em OpenStack e seu posicionamento como cloud integrator

, May 29, 2017

Rede varejista Angeloni agiliza transações comerciais com solução de armazenamento totalmente flash da Pure Storage

Tecnologia de armazenamento da Pure Storage permitiu à 10ª maior rede varejista do País reduzir em 10x ou mais o tempo de resposta para bancos de dados que envolvem os processamentos de atividades diárias, principalmente transações online. O Angeloni conseguiu diminuir em até 50% o tempo de geração de relatórios internos.

, Apr 25, 2017

Logicalis reforça atuação como cloud broker

Estratégia visa ajudar empresas a migrarem suas aplicações para nuvem no modelo mais adequados ao seu negócio

, Apr 11, 2017

Logicalis dá mais um passo na integração da operação latino-americana

Empresa unifica gestão dos países de língua espanhola e consolida as operações regionais de sua área de serviços

, Mar 2, 2017

PromonLogicalis passa a usar a marca Logicalis no Brasil

Mudança ocorrerá a partir de 1º de março e visa reforçar a integração regional e facilitar a comunicação com os principais interlocutores da empresa

, Mar 1, 2017

PromonLogicalis passa a usar a marca Logicalis no Brasil *******

Mudança ocorrerá a partir de 1º de março e visa reforçar a integração regional e facilitar a comunicação com os principais interlocutores da empresa

, Feb 21, 2017

PromonLogicalis reforça atuação em infraestrutura definida por software

Com experiência em cloud Computing e virtualização, Alex Hübner liderará as atividades da empresa na área de Software Defined Infrastructure (SDI) tendo a tecnologia OpenStack como um de seus principais pilares

, Feb 17, 2017

PromonLogicalis reforça atuação em infraestrutura definida por software

Com experiência em cloud Computing e virtualização, Alex Hübner liderará as atividades da empresa na área de Software Defined Infrastructure (SDI) tendo a tecnologia OpenStack como um de seus principais pilares

, Jan 11, 2017

PromonLogicalis anuncia novo diretor de vendas

Executivo comandará área de negócios com foco no desenvolvimento de soluções alinhadas às necessidades de diferentes verticais

, Oct 17, 2016

PromonLogicalis apresenta soluções de IoT para diferentes setores na Futurecom 2016

Empresa demonstrará soluções de conectividade que transformarão o dia a dia dos negócios e das pessoas

, Sep 27, 2016

PromonLogicalis e Ixia anunciam parceria para América Latina

Acordo envolve soluções de segurança, teste e visibilidade de rede com foco nos mercados corporativo, de data centers e de operadoras

, Jun 22, 2016

PromonLogicalis anuncia parceria com IP Trade

A PromonLogicalis acaba de fechar uma parceria com a IP Trade, líder em comunicação e colaboração em tempo real para mesas de operações. Juntas, as empresas oferecerão ao mercado uma solução de colaboração avançada para atividades críticas de diversos setores, como bancos, corretoras de valores, aviação e concessionárias de energia.

, Jun 21, 2016

PromonLogicalis apresenta sua visão sobre blockchain durante o CIAB

De olho no potencial do blockchain, base de dados de transações distribuídas, para o mercado financeiro, a PromonLogicalis, provedora de soluções e serviços de tecnologia da informação e comunicação na América Latina, apresenta sua proposta de valor sobre o tema durante o CIAB Febraban, Congresso e Exposição de Tecnologia da Informação das Instituições Financeiras, que ocorre entre os dias 21 e 23 de junho, em São Paulo.

, May 25, 2016

PromonLogicalis é uma das 20 Melhores Empresas para Trabalhar na América Latina

A PromonLogicalis conquistou o 17º lugar no prêmio “Melhores Empresas para Trabalhar na América Latina – mais de 500 colaboradores”, duas posições acima da alcançada no ano anterior. A empresa é a única do setor de tecnologia da informação a constar no ranking, realizado pelo Instituto Great Place to Work.

, May 11, 2016

PromonLogicalis lança Wingo para aprimorar experiência do cliente

A PromonLogicalis apresenta a plataforma Wingo, uma solução completa que inclui hardware, serviços e consultoria. Trata-se de uma plataforma que permite às empresas expandirem o uso de suas redes Wi-Fi, seja coletando informações sobre seus usuários ou entregando conteúdos personalizados a eles.

, May 10, 2016

Combinação de wi-fi e analytics mudará experiência do consumidor

Cada vez mais as tecnologias estão presentes em todos os ambientes. A junção de diferentes ferramentas possibilita um melhor entendimento do comportamento dos clientes e a oferta de uma experiência personalizada a eles. A PromonLogicalis acredita que as soluções de analytics são fundamentais para conhecer melhor os consumidores e, quando combinadas a outras tecnologias, permitem um aproveitamento ainda melhor dos dados.

, May 9, 2016

PromonLogicalis é considerada Rising Star no ranking The 2016 Global Outsourcing 100

A empresa foi destaque nas categorias Referência de Clientes, que avalia o valor percebido por eles, Prêmios e Certificações, que analisa os prêmios e reconhecimentos recebidos pelos profissionais e pela organização, e Tamanho e Crescimento, na qual são mensurados a receita, o faturamento, o número de funcionários e a presença global.

, Apr 6, 2016

Para PromonLogicalis, operadoras precisam inovar para fidelizar os clientes

O tráfego de dados no Brasil aumentará sete vezes entre 2015 e 2020*. Garantir a disponibilidade e a qualidade dos serviços de conectividade aos clientes são dois dos grandes desafios das operadoras de telefonia. Porém, para fidelizar seus clientes, as operadoras precisam mais do que atender suas expectativas, precisam superá-las. A PromonLogicalis oferece um portfólio completo para as operadoras: desde tecnologias de acesso até a gestão da experiência do cliente.

, Apr 5, 2016

Consumidor será o motor da transformação do setor elétrico, afirma PromonLogicalis

O setor de utilities mundial vem passando por inúmeras mudanças nos últimos anos, especialmente devido aos avanços das tecnologias envolvidas em sua operação. Para ajudar as empresas do setor a modernizarem a sua infraestrutura e oferecerem um serviço de alta qualidade aos usuários, a PromonLogicalis aposta em três grandes pilares: digitalização, engajamento do consumidor e eficiência operacional.

, Apr 4, 2016

PromonLogicalis fortalece estratégia de serviços e se posiciona como cloud integrator

Em linha sua sua estratégia de fortalecimento de serviços, a PromonLogicalis posiciona-se como cloud integrator, oferecendo atendimento consultivo e totalmente customizado para ajudar as empresas a direcionarem os seus esforços de cloud computing.

, Mar 28, 2016

Para PromonLogicalis, IoT é o caminho para tornar as cidades mais inteligentes

A tecnologia é, cada vez mais, parte do dia a dia de pessoas e organizações. Na administração pública não poderia ser diferente – embora, muitas vezes, o processo de adoção seja um pouco mais lento. Para ajudar as empresas e o setor público a ingressarem nesse universo digital e tornar as cidades mais inteligentes, a PromonLogicalis, provedora de serviços e soluções de tecnologia da informação e comunicação na América Latina, participa do SmartCity Business America Congresso & Expo, que será realizado em Curitiba entre os dias 28 e 30 de março.

, Mar 22, 2016

Portal mapeia ocorrências do Aedes aegypti no País

Os últimos surtos de dengue, zika e chikungunya no Brasil aumentaram ainda mais a preocupação das pessoas e os cuidados em relação ao Aedes aegypti, mosquito que transmite essas doenças. Pensando nisso, a PromonLogicalis, provedora de serviços e soluções de tecnologia da informação e comunicações na América Latina, desenvolveu o Radar Aedes, um portal que reúne informações geolocalizadas sobre as ocorrências do mosquito em todo o País com o apoio da população. O objetivo é ser um hub de informações sobre o tema e, desta forma, ajudar no combate ao inseto.

, Mar 11, 2016

Logicalis Latin America é premiada pela Cisco em nove categorias

Operação brasileira destacou-se com a conquista de quatro prêmios, entregues durante o Cisco Partner Summit 2016

, Mar 1, 2016

Logicalis Latin America reforça estrutura de liderança

Com o objetivo de se preparar para as transformações tecnológicas e de negócios dos próximos anos, a Logicalis Latin America, provedora de serviços e soluções de tecnologia da informação e comunicação na América Latina, anuncia uma reestruturação de suas operações e reforço da liderança, tanto no Brasil quanto na América Latina.

, Feb 22, 2016

PromonLogicalis está entre as 100 melhores prestadoras de serviços de outsourcing do mundo

A PromonLogicalis foi eleita uma das 100 maiores e melhores prestadoras de serviços pelo Global Outsourcing 100.

, Feb 15, 2016

Estudo da PromonLogicalis aponta que gestores na América Latina acham TI mais estratégica que CIOs de outras regiões do mundo

Grande parte dos profissionais de TI na América Latina consideram que o peso que a área de TI tem nos resultados do negócio é maior que nas demais regiões analisadas (Europa, Estados Unidos, Ásia, Países Árabes, China e Austrália). Numa comparação, 28% dos gestores latino americanos deram nota máxima quando analisam a importância de TI nos resultados, enquanto na Europa e nos EUA a nota máxima foi a resposta de 17% dos gestores, de 15% na APAC (Ásia, Países Árabes e China) de 8% na Austrália.

, Aug 8, 2014

PromonLogicalis conquista a 9a posição entre as “Melhores Empresas para Trabalhar TI e Telecom”, do GPTW Brasil

Premiação é reflexo dos investimentos e da preocupação da empresa em manter um ambiente de trabalho agradável e propício à inovação e ao desenvolvimento profissional.

, May 21, 2014

PromonLogicalis debate sobre segurança na modernização da rede elétrica

Durante L.E.T.S, integradora participa do painel “Smartgrids e as interfaces entre energia e telecomunicações” e mostra sua visão sobre evolução das redes e riscos do processo.

, Apr 28, 2014

PromonLogicalis debate a eficácia das plataformas SON nas redes móveis durante o LTE Latin America 2014

Durante o evento, integradora apresenta sua visão sobre o papel de tecnologias como small cells e soluções de software na melhoria do desempenho das redes móveis

, Apr 1, 2014

PromonLogicalis apresenta sua visão sobre o impacto do SDN nos atuais data centers

Durante conferência do Gartner, empresa explica como o conceito de arquitetura definida por software impactará o futuro dos data centers e mudará a gestão da infraestrutura de TI nas empresas

, Feb 25, 2014

A Logicalis recebe certificação TelePresence Video Master Satellite da Cisco na região CANSAC

Na Logicalis, contamos com diversas certificações da Cisco, que refletem nossas habilidades nas tecnologias de colaboração, voz e vídeo.

, Feb 10, 2014

PromonLogicalis e Ascenty anunciam parceria

Juntas, empresas oferecem ao mercado o que há de mais moderno em soluções de data center e serviços gerenciados de TIC.

, Dec 16, 2013

Logicalis adquire quatro operações europeias da 2e2

O acordo dará início à estratégia de expansão da integradora na Europa continental

, Dec 16, 2013

A Logicalis incorpora novo aliado na região: Acme Packet

Recentemente associou-se à Acme Packet, líder em session delivery networks, que oferece uma entrega segura de serviços de próxima geração de voz, dados, comunicações unificadas e aplicativos através de redes IP.

, Dec 16, 2013

Logicalis, Elite Partner da Blue Coat

A Blue Coat promoveu a Logicalis ao nível Elite Partner, o mais alto entre seus aliados, após completar um processo de alta certificação e treinamento técnico sobre as soluções Blue Coat.

, Dec 16, 2013

A adoção de BYOD é mais rápida em mercados de rápido crescimento

Um relatório do Instituto Ovum, encomendado pela Logicalis, revela que 57,1% dos funcionários de tempo integral participa de programas de Bring Your Own Device.

, Dec 16, 2013

Blue Coat consolida aliança com a Logicalis na América Latina

O acordo permite que a Logicalis adquira sistemas de segurança de rede diretamente da Blue Coat para integrá-los aos projetos que oferece ao setor público, a clientes corporativos e ao mercado de telecomunicações.

, Dec 11, 2013

Logicalis e Red Hat, novo acordo na Argentina

A companhia continua fortalecendo sua oferta de data center adicionando a Red Hat como nova aliada.

, Dec 11, 2013

Estivemos na Andicom 2013

Entre os dias 28 e 30 do mês de agosto, a Logicalis participou mais uma vez do Congresso Internacional de Tecnologia e Comunicação Andicom, realizado anualmente em Cartagena, na Colômbia.

, Dec 11, 2013

Logicalis Latin America inicia operações no México

Movimento dá continuidade à expansão e integração das operações latino-americanas da empresa

, Nov 13, 2013

PromonLogicalis apresenta sua visão sobre SDN em redes corporativas no Gartner Symposium/ITxpo 2013

Nova arquitetura de redes é alicerce para suportar cenário atual das redes corporativas cada vez mais conectadas

, Nov 11, 2013

Rodrigo Parreira é o novo CEO da PromonLogicalis

Executivo tem como missão dar continuidade ao ritmo de crescimento da integradora e consolidar suas operações na América Latina

, Nov 11, 2013

Diego Martinez é o novo COO da Logicalis Andina

Com mais de 20 anos de experiência no setor, executivo tem a missão de fortalecer a presença e ampliar os negócios da empresa na região

, Nov 11, 2013

PromonLogicalis anuncia aquisição de operações da Cibercall na Colômbia e no Equador

Negócio tem como objetivo fortalecer a atuação da integradora na região andina.

, Nov 8, 2013

PromonLogicalis divulga estudo sobre transformação da telefonia móvel com a chegada da rede 4G

A quarta geração de telefonia móvel chega em um momento de grande transformação do mercado de dados.

, Nov 8, 2013

PromonLogicalis registra crescimento de 31% no Brasil

Receita líquida da empresa no país totalizou R$704 milhões no ano fiscal encerrando em fevereiro de 2013.

, Nov 8, 2013

Logicalis Latin America é eleita pela Cisco como parceira do ano na América Latina

Prêmio foi recebido pelo CEO da Logicalis Latin America, Rodrigo Parreira, durante o Cisco Partner Summit 2013

, Nov 8, 2013

Pesquisa da PromonLogicalis aponta que mercado brasileiro de TIC tem nível intermediário de maturidade

Estudo Brazil IT Snapshot 2013 avalia área de TI corporativa com base nos pilares de segurança da informação, continuidade de negócios, computação em nuvem e mobilidade.

, Nov 8, 2013

PromonLogicalis firma parceria com AirWatch

Acordo complementa o portfólio da provedora com soluções de mobilidade empresarial e segurança de dispositivos móveis.

, Nov 8, 2013

PromonLogicalis apresenta sua visão sobre as principais tendências do mercado de TIC durante a 15ª edição do Futurecom

Mais uma vez, empresa participa do evento ao lado de alguns de seus principais parceiros, como Airwatch, Arbor, BlueCoat, CA, Cisco, Nominum e Panduit.

, Oct 29, 2013

Desempenho da Logicalis na América Latina é destaque nos resultados da Datatec

Controladora divulgou os resultados do primeiro semestre do ano fiscal (H1 FY13), encerrado em 31 de agosto